Electric Everywhere: Where EV’s are Headed Next

Key Insights

The global electric vehicle market has grown to 4.6% of total car sales as of 2020, showing a 70% increase from 2019.

National government incentives along with support for EV growth campaigns will play a massive role in the growth of EVs as a fraction of total car sales over the next decade.

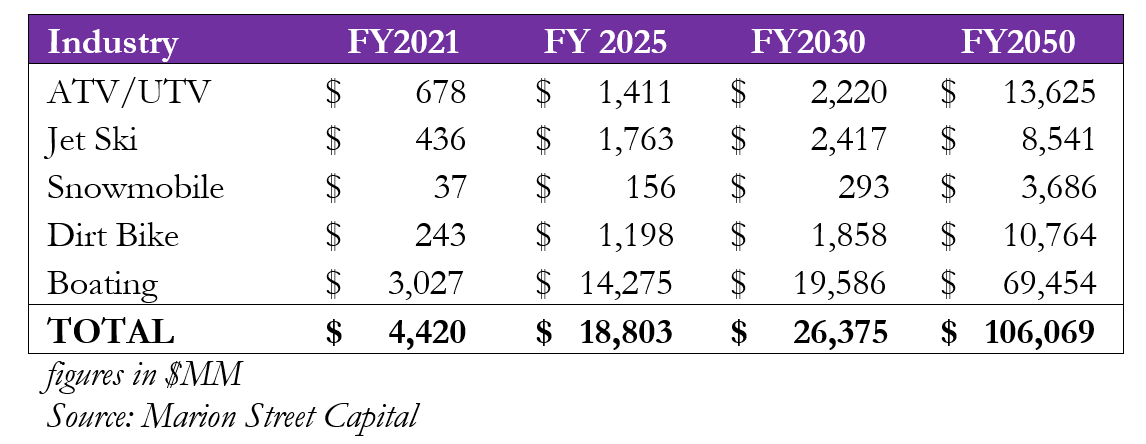

Marion Street Capital identifies five additional verticals that are currently developing and adapting electric technology with commercial potential: ATV/UTV, Jet Ski, Snowmobile, Dirt Bike, and Boating. The electric market for these industries currently represents $4.4B and may represent $18.8B by 2025.

Key consumer concerns are largely being addressed by the startups and emerging firms in these industries, however Marion Street Capital estimates that it may take 3-5 years before mass markets accept and adopt this technology fully.

While there is significant potential in adjacent industries for adaptation of EV technology, investors and stakeholders should perform an extra layer of diligence, given SEC investigations of high-profile public companies such as the Nikola Motor Company and Lordstown Motors.

Market Overview

The electric vehicle industry market has experienced rapid growth over the past 10 years. From 2019-2020, the global electric car stock saw a 43% increase to surpass the 10MM milestone. While overall global car registrations were down on a year-by-year basis in 2020 due to the global pandemic, global electric car sales managed to reach 4.6% of total car sales, a 70% increase from 2019.[1] The 4.6% share of total sales leaves EVs plenty of room for potential growth over the next decade. Some forecasts project this 4.6% share of total car sales to reach the 29.5% threshold by 2030.[2]

In 2020, roughly $14B was spent by world governments on direct purchase incentives and tax deductions for electric vehicles. 14 national governments have endorsed the EV30@30 campaign, an initiative set to achieve a 30% sales share for EVs by 2030. The Drive to Zero campaign has been endorsed by 9 national governments to help catalyze electric vehicle manufacturing and produce commercial vehicles that are “zero-emission.”[3] Global government focus on lowering carbon emissions and moving towards a clean-energy future will undoubtedly be a big player in the forward production and sales growth of electric vehicles. Overall, the electric vehicle industry is blazing the path towards being a market leader over gas-powered vehicles. While the story for the car is a few chapters in, the story for other applications is just beginning.

Electric Everywhere

The creation of the affordable electric car and truck is only the beginning for the broader automotive and motor vehicle sector. Marion Street Capital identifies five additional verticals that are currently developing and adapting electric technology: ATV/UTV, Jet Ski, Snowmobile, Dirt Bike, and Boating. The electric market for these industries currently represents $4.4B and may represent $18.8B by 2025.

The top existing concerns for consumers looking to shift to electric are largely being addressed by these emerging firms.[4] Similar to the car, it will likely take 3-5 years before mass market acceptance and growth in market share. These top concerns are:

Cost. These products will be similar in price to existing, gas-powered products on the market.

Range. Vehicles from emerging firms will have relatively significant range and specs compared to gas-powered.

Charging Infrastructure. Marion Street Capital suggests this is the most significant concern consumers should have, considering many of these vehicles will be used in rural and remote areas, including in the water. Manufacturers will have to form partnerships or build their own charging infrastructure.

Accessible Service Expertise. Electric vehicles require 40% less maintenance than gas-powered vehicles[5]. Emerging firms are actively educating the public about this key difference in operational cost and reliability on skilled service teams in the area.

Incumbent vs. Emerging Firms

Emerging firms and startups in the industry have significant capital requirements to develop, scale, and market their electric technology. EV automaker Tesla spent $104MM on CapEx and R&D before generating sales. Incumbent firms with traditional gas-powered vehicles must decide whether to deploy their own capital to retain the customers who desire a shift to electric, acquire an emerging firm, or do nothing altogether.

Considering the traditional automotive industry, traditional automakers did not think of emerging firms like Tesla to be a significant threat until they started to deliver mass amounts of vehicles, become economically viable, and take chunks out of their market share. Now, firms like Ford, BMW, and others are racing to break into the electric market and shift their product mix, with an uncertain ROI because they did not act sooner.

Marion Street Capital expects the situation in these new industries to be quite similar. Considering the ATV/UTV industry, for example, incumbent market leader Polaris has 48% market share. The company made limited investment in electric technology previously, commercializing a limited number of products, including the Ranger EV, with limited range and features. Now it sees competition on the horizon. Before, it made logical sense- why would Polaris invest hundreds of millions of dollars to retain its’ current customers? Now it is taking action. Polaris reached a 10-year technology partnership with Zero Motorcycles to help build electric snowmobiles and other off-road vehicles. Polaris promised an electric alternative to every one of its core products by 2025.[6]

Spotlight on Emerging Firms

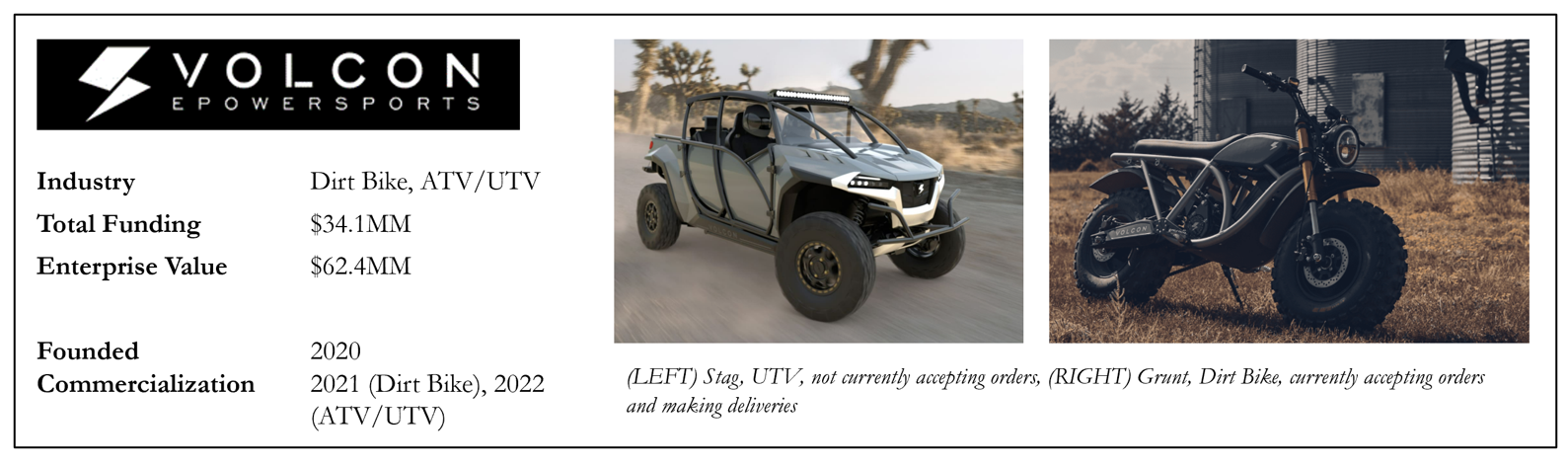

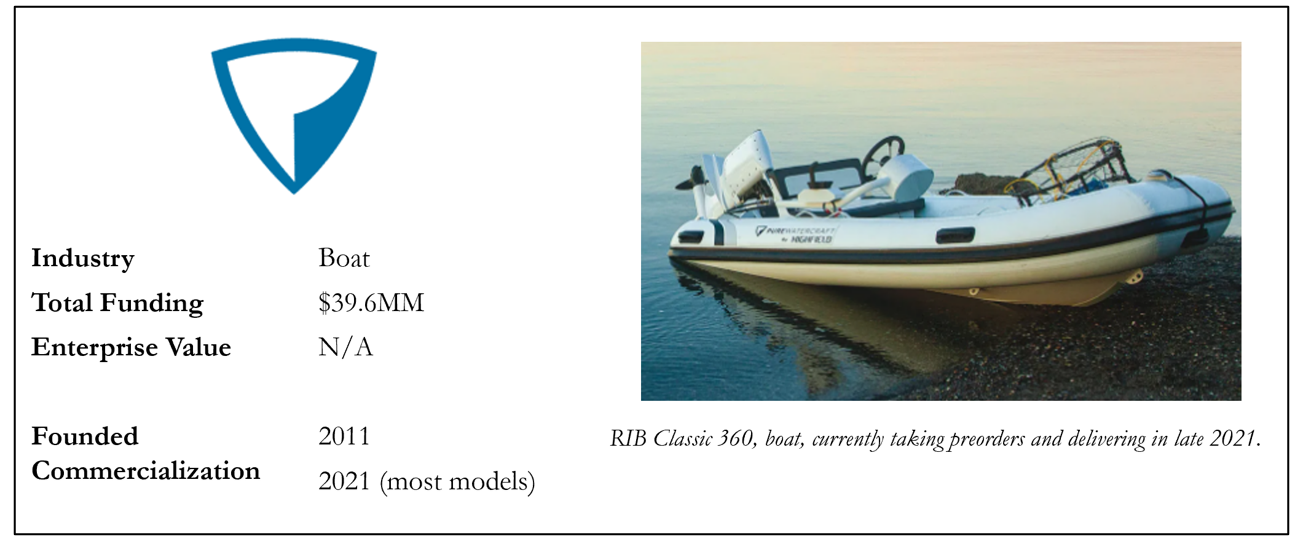

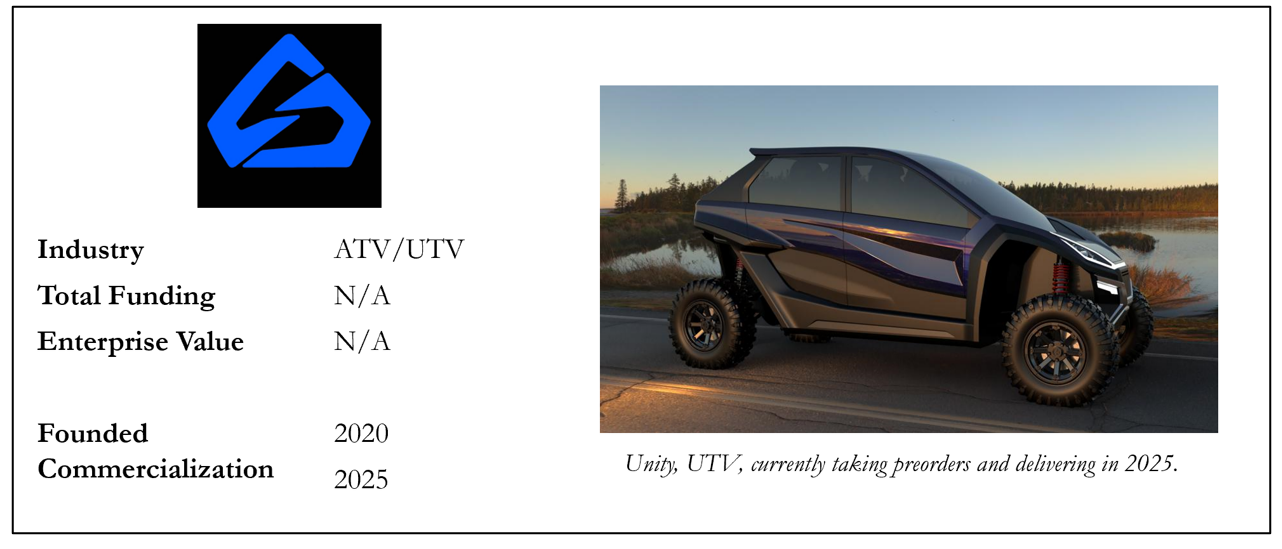

Several emerging firms in each of these verticals aim to capture the market share of the respective legacy, gas-powered firms. These firms are attracting substantial amounts of capital from public and private markets, despite the high capital requirements. Find a snapshot of a few of these companies below:

A Note on Risk

Investors and stakeholders should apply an extra layer of technical diligence when evaluating opportunities in the EV space. Private and public markets, which experienced significant growth over the past decade have led to a number of high-profile investigations into public companies such as the Nikola Motor Company and Lordstown Motors, among others.[7],[8]

Both of these companies went public without a finished product, multi-billion dollar valuations, and without revenue. GM invested $2B in Nikola and $75MM in Lordstown to create and commercialize their electric trucks, deals that immediately fell apart for the legacy automaker.[9],[10] Beyond these two companies, Volcon E-Powersports went public in early October 2021, also without any revenue and with just one year in operating history.[11]

As a key takeaway, investors and stakeholders must understand that while electric vehicle technology is now prevalent globally, it is not a commodity. These new applications still require exquisite engineering capability that takes multiple years to develop, adapt, and commercialize. As Nikola and Lordstown Motors shown, even the public markets and major corporations are not immune to believing these false or misleading claims.

About Marion Street Capital

Marion Street Capital (MSC) is a business growth consultancy helping innovative growth companies solve their most pressing challenges.

We collaborate with ambitious leaders to provide time-saving partnership, unparalleled support, and world-class expertise designed to ensure lasting business success — at scale. We work with clients to achieve growth of 10x or more by delivering world-class services in five key areas: FinOps, DataOps, RevOps, HROps, and SpecialOps.

MSC’s resources include relationships with institutional investors (family office, private equity firms, venture capital firms, hedge funds, and mutual funds), relationships with local and international banks, “expert networks,” relationships with top academic institutions, outsourced software development teams, graphic design services,

and industry information providers. This robust suite of services enabled MSC to help clients across 16 different industries during the last two years

Footnotes

[4] Top Concerns for Going Electric

[5] Argonne National Laboratory

[6] Polaris & Zero Motorcycles

[8] Lordstown Motors SEC Investigation