Unlocking the Potential of the Plant - Overcoming Limitations in Cannabis

Key Insights

Marion Street Capital (“MSC”) recommends that cannabis firms professionalize their financial planning and analysis functions to successfully attract capital. Investment funding into cannabis decreased nearly 68% during 2020 because companies presented unrealistic financial projections. Investment funding to cannabis firms reached a record in 2019 at $1.9B, but it has not yet reached its full potential. Limited access to institutional funding and lack of basic business benefits remain two of the largest obstacles for the cannabis industry in the U.S. According to Forbes, the legal cannabis market may reach $43B annual revenue by 2025, offering access to 141MM (or 41%) of the American adult population.

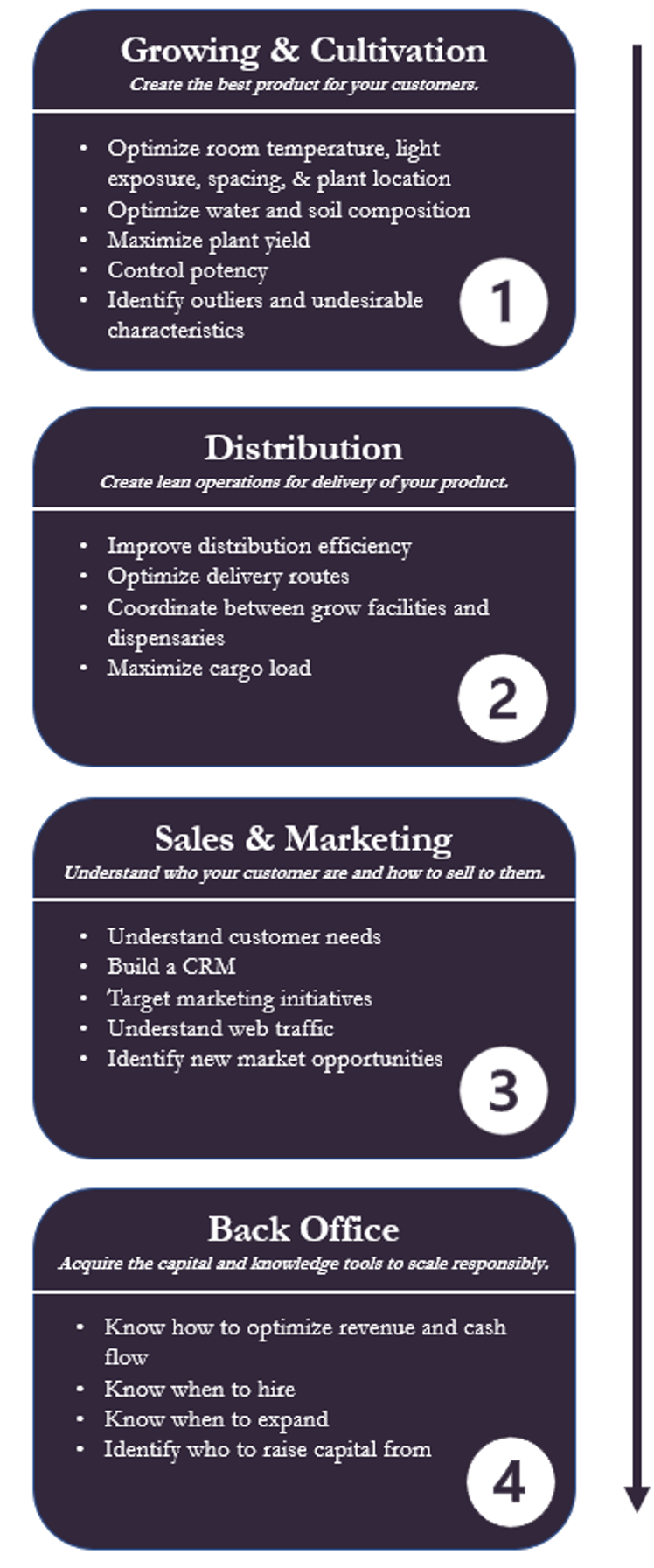

MSC also recommends that firms, specifically growers, should allocate resources into business intelligence and finance to help gain competitive advantages through data, and to avoid costly fines. As growers and related firms scale, data strategy is a key issue that may limit growth and success. Data leaks can result in fines between $7,500 and $50,000 per incident if it includes medical records, which is a HIPAA violation.[1] Firms can collect, utilize, and act on data that benefit their own firm through the cultivation, distribution, sales, and back-office processes while creating a valuable platform for other firms to access.

Background

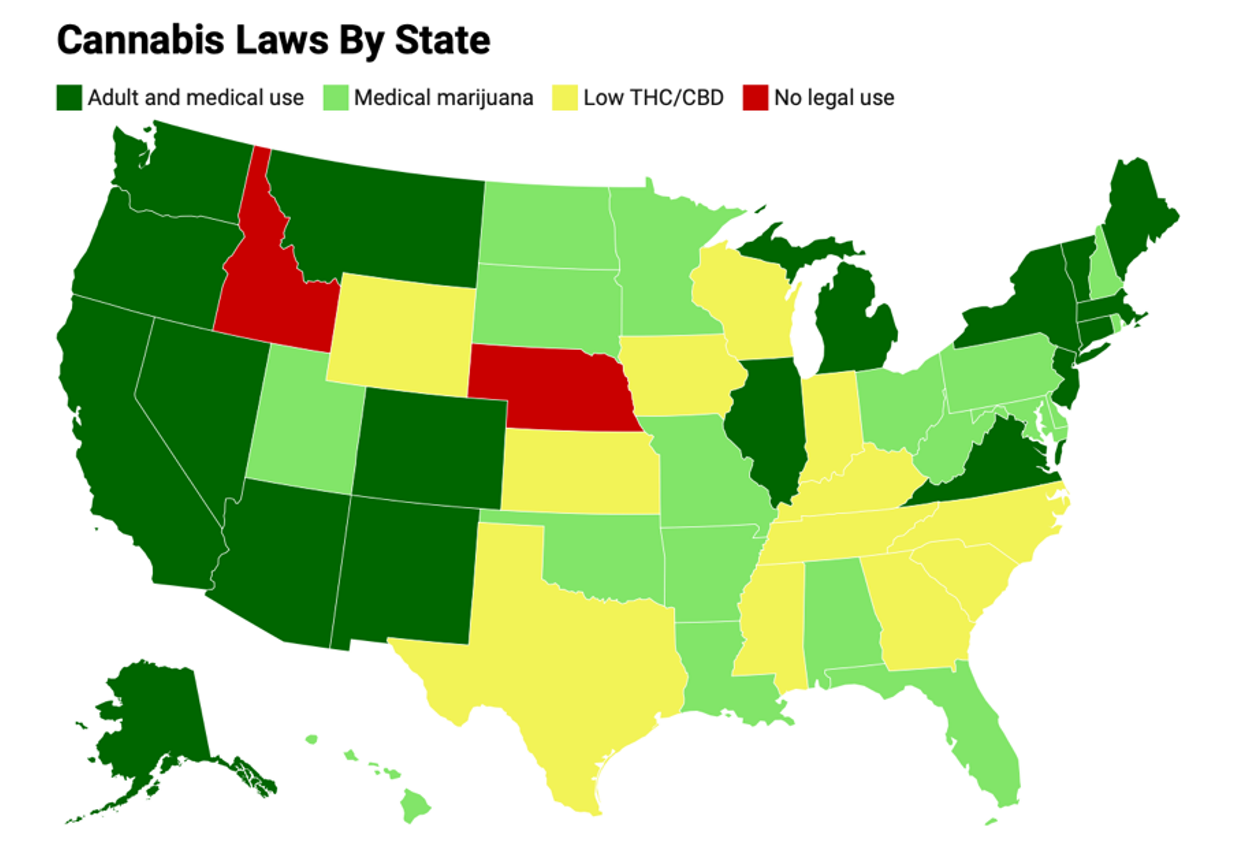

The cannabis industry is experiencing significant growth as new firms enter the market, new states legalize recreational and/or medicinal use, and as existing firms expand within current legal markets. As of November 2021, there are only two states in which cannabis is fully illegal.[2] Cannabis is fully legal in 18 states, with a path towards full legalization in many more.[3] Over 141MM Americans live in these 18 states, and according to Forbes, the market may reach $43B annual revenue by 2025 with 10 newly legalized states beginning sales.[4]

The cannabis industry is demonstrating growth beyond politics and ideologies, paving the way for exponential growth. Historically, the cannabis industry was viewed through a political lens due to industry dependence upon regulators from different political parties. Traditionally conservative states such as Arizona, Mississippi, Montana, and South Dakota legalized either medical or recreational adult-use cannabis.

One of the largest obstacles the industry faces is the history of marijuana as an illicit substance, and with it, obscure activities related to the plant. Data and institutional support are crucial for the industry to reach its growth potential.

Becoming a Market Leader Through Data [5]

By law, cannabis firms are required to collect and report their data. This data helps regulators and lawmakers make more informed decisions and accelerate the path towards nationwide commercialization.[6] Successful startup Eaze, which raised over $200MM to date in funding, understands how impactful data can be on both the policy and business side:[7]

“We have access to aggregated medical marijuana usage data that has been unaccessible to regulators for years,” says Scott Dunlap, CMO of Eaze. “We’re uniquely able to work with policy makers in local and state government to help them understand the industry better and thus create regulation which enables patients to access their medicine safely and conveniently.”

In this emerging industry, data is so critical and complex that many companies have not yet implemented key processes to effectively track, measure, and monetize it. Creating a lean and efficient data function that integrates with finance will best position the firms looking to scale.

Emerging cloud firms in the industry such as Metrc, Treez, LeafLogix and more are focusing on making the cannabis supply chain as transparent and safe as possible. From monitoring cultivation operations to monitoring each product sold in dispensaries, cloud firms understand how critical it is to safely monitor data to inform decision making.

Data leaks can result in fines between $7,500 and $50,000 per incident if it includes medical records, which is a HIPAA violation.[8]

Sourcing Capital in a Complex Regulatory Environment

Limited access to funding and lack of basic business benefits remain two of the largest obstacles for the cannabis industry in the U.S.[9] Cannabis remains a Schedule I controlled substance under federal law. Schedule I substances are defined as substances with no currently accepted medical use and a high potential for abuse.[10] Many cannabis businesses are unable to access banking services due to anti-money laundering laws and may be ineligible for certain federal tax deductions. Furthermore, bankruptcy courts may be prevented to approve bankruptcy plans, limiting options for promising growth companies in the industry.

The Financial Crimes Enforcing Network (FinCEN) issued guidelines in 2014 describing how financial institutions could do business with companies in the cannabis industry without triggering the Bank Secrecy Act (BSA) enforcement, strongly recommending a detailed due-diligence process.[11] These guidelines are based on principles from the Cole Memorandum,[12] rescinded in 2018. However, risk remains that banking regulators or law enforcement agencies act against financial institutions that provide services to cannabis related businesses.

Due to limited access to institutional funding, investors who see the high-growth opportunity in the industry are creating specialized funds to help companies across the world access the capital needed to continue scaling. Increased participation from investors resulted in $1.9B of funding in 2019. Funding in 2020 decreased nearly 68% due to companies presenting unrealistic financial projections.[13]

As the U.S. works towards federal legalization, companies in the cannabis industry must be ready to access funding and participate in a market with a $43B potential in the short term. By recruiting expertise with fundraising experience and knowledge of the due diligence process enforced by financial institutions and regulatory agencies, industry competitors can achieve high growth.

About Marion Street Capital

Marion Street Capital (MSC) is a business growth consultancy helping innovative growth companies solve their most pressing challenges.

We collaborate with ambitious leaders to provide time-saving partnership, unparalleled support, and world-class expertise designed to ensure lasting business success — at scale. We work with clients to achieve growth of 10x or more by delivering world-class services in five key areas: FinOps, DataOps, RevOps, HROps, and SpecialOps.

MSC’s resources include relationships with institutional investors (family office, private equity firms, venture capital firms, hedge funds, and mutual funds), relationships with local and international banks, “expert networks,” relationships with top academic institutions, outsourced software development teams, graphic design services,

and industry information providers. This robust suite of services enabled MSC to help clients across 16 different industries during the last two years.

Footnotes

[1] https://newfrontierdata.com/cannareturn/leak-of-30000-cannabis-customer-records-heightens-need-for-effective-data-security/

[2] https://www.forbes.com/sites/willyakowicz/2021/11/18/why-the-legal-cannabis-industry-is-high-on-the-american-south/?sh=2928eeb37eb6

[3] https://disa.com/map-of-marijuana-legality-by-state

[4] https://www.forbes.com/sites/irisdorbian/2021/06/18/legal-cannabis-market-projected-to-rack-up-43-billion-by-2025-says-new-study/?sh=1e4559ed36b4

[5] https://www.zuar.com/blog/cannabis-industry-leader/

[6] https://mixpanel.com/blog/marijuana-tech-startups/

[7] https://www.crunchbase.com/organization/eaze-2

[8] https://newfrontierdata.com/cannareturn/leak-of-30000-cannabis-customer-records-heightens-need-for-effective-data-security/

[9] https://sgp.fas.org/crs/misc/R45948.pdf (p27)

[10] https://www.dea.gov/drug-information/drug-scheduling

[11] https://www.fincen.gov/resources/statutes-regulations/guidance/bsa-expectations-regarding-marijuana-related-businesses

[12] https://www.justice.gov/iso/opa/resources/3052013829132756857467.pdf

[13] https://news.crunchbase.com/news/cannabis-startups-navigate-regulations-lack-of-capital-to-plant-industry-seeds/