How much should a recession matter to an early-stage company?

Timing of recessions should matter less to the seasoned entrepreneur than diligently planning, funding, and building a sustainable business.

Figure 1. St. Louis Federal Reserve Bank History of Recessions preceded by Treasury curve inversions[1]

This is far more difficult than stories of entrepreneurial glamor indicate, and recessions make these activities seem more daunting as investment capital grows more scarce, workforce wanes, and as private company valuations become less favorable to entrepreneurs. However, competition wanes and opportunity cost for planning and building declines during recessions, which the chart above depict as relatively infrequent short events. The grey shaded regions on this chart represent recessions, while the wide white regions represent expansions. The three Marion Street Capital (MSC) playbooks for early-stage companies do not change during recessions, though we may selectively favor either offensive or defensive strategies for some companies and industries. We built these three playbooks by helping client companies get financing and solve real challenges to grow from $0 to $1MM, from $1MM to $10MM, and from $10MM to $100MM annual revenue during an economic expansion, contraction, and subsequent expansion.

Are technology stocks freaking out about a recession?

Technology stocks likely foresaw one or two quarters of real GDP decline, and they reacted to meaningful increases in interest rates.

Figure 2. Goldman Sachs Non-Profitable Tech Basket Index[2]

On April 28th, the Bureau of Economic Affairs released its advance estimate of first quarter 2022 (1Q22) real Gross Domestic Product (GDP), which spurred headlines such as, “U.S. GDP fell at a 1.4% pace to start the year as pandemic recovery takes a hit,” after the NASDAQ had already declined (13%) month to date and (22%) from its peak in late November on its way to a (30%) total decline earlier this month. Meanwhile, an index of stocks for unprofitable technology companies declined from over 400 to the lower 100’s, giving up almost all its pandemic gains, and a Silicon Valley billionaire “rang the bell” for lofty private company valuations.

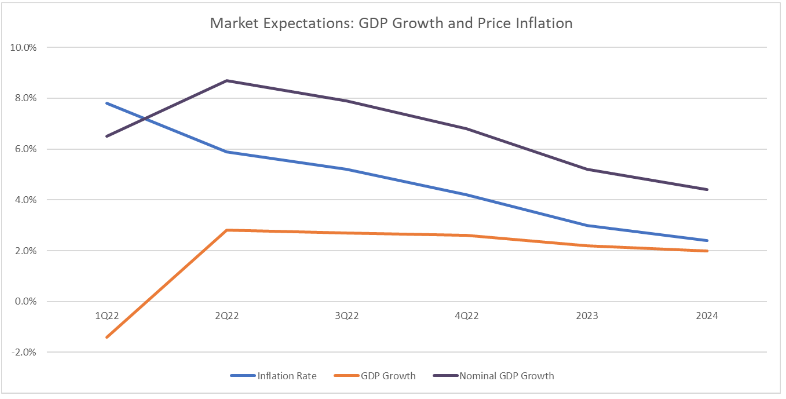

Figure 3. Market expectations for GDP growth and price inflation

Although the US economy may see a second consecutive quarter of negative real Gross Domestic Product (GDP), it is unlikely to experience a “recession” now because the National Bureau of Economic Research (NBER) is unlikely to qualify 1H22 as a period of “significant decline in economic activity.”[3] The Bureau of Economic Affairs (BEA) defines a recession as “the province of a committee of experts at the National Bureau of Economic Research (NBER), a private non-profit research organization that focuses on understanding the U.S. economy.”[4] Most practitioners define a recession more simply as two consecutive quarter-over-quarter declines in real GDP, but the NBER takes a more subjective tact, which does not always align with the practitioner’s definition.[5] The NBER looks for significant declines in economic activity, and the definition of “real GDP” is important to handicapping the odds that the NBER observes this during 1H22. Real GDP is “current-dollar GDP” divided by a GDP deflator, which is a proxy for inflation. In its recent release, the BEA indicated that nominal GDP increased from a seasonally adjusted and annualized level of $24.0T 4Q21 to $24.4T 1Q22, a 1.6% increase that the BEA annualized to 6.5%, down from 14.5% 4Q21. However, the price index for gross domestic purchases increased 7.8% during 1Q22, up from 7.0% 4Q21. Therefore, the 1Q22 price index rose faster than “current-dollar” or “nominal” GDP, leaving seasonally adjusted and annualized real 1Q22 GDP a NEGATIVE (1.4%) down from +6.9% during 4Q21. Meanwhile, FactSet indicates that market participants expect decelerating inflation rates and steady increased rates of real GDP growth, implying improved though decelerating growth in nominal GDP, per Figure 3 above. All this indicates that 2Q22 should be witnessing some “bounce” in economic activity as Omicron subsided, and from 2H22 through 2024 the economy should decelerate without outright declining. Market forecasts could be wrong, but MSC is not seeing any evidence unavailable to the wider market upon which we could justify a dourer forecast. Therefore, we conclude that absent an unexpected significant economic shock, the NBER committee is unlikely to “province” a recessionary declaration.

Figure 4. US Treasury curves during the past year[6]

Stocks of technology companies with no current earnings are exceptionally sensitive to interest rate movements, and they should decline when interest rates rise. Figure 4 above illustrates the material increase in interest rates that transpired during the past year. Last year, the 10-year Treasury rate was around 1.75%, and it declined to less than 1.50% by early December before nearly doubling to almost 3.00% a week ago. MSC values such companies using one of the following three approaches:

Discounted Cash Flow (DCF)

Comparable public company valuations

Precedent private transactions (exits or venture fundings)

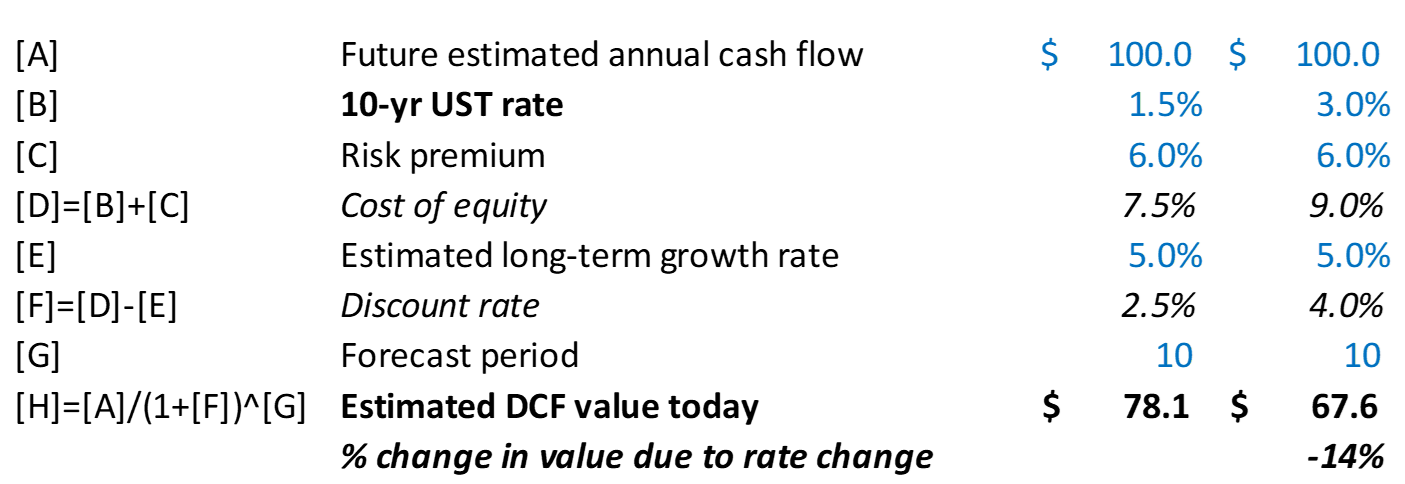

Approach #1 incorporates interest rates directly, while approach #2 does so indirectly, and approach #3 does so, but with a significant lag. The DCF approach requires MSC to forecast future company cash flows over a five or ten-year period, to estimate a growth rate for those cash flows beyond that forecast period, and to discount those cash flows back to today. We use a discount rate that incorporates today’s 10-year Treasury rate, an additional estimated premium to reflect the risk of the company and its industry, and the estimated long-term growth rate. Figure 5 below illustrates that a 1.50% increase in 10-year US Treasury rates could justify a 14% decline in valuation. If one were to also cut the forecast growth rate in half from 5.0% to 2.5%, the revised valuation would be 32% lower than the initial $78 figure at the bottom of the left column in Figure 4.

Figure 5. Estimated impact of a 1.50% change in UST rates to a DCF valuation[7]

Approach #2, comparable public company valuations, also incorporate interest changes, but indirectly. As Figure 5 above illustrates, any public company with this cash flow and risk profile will suffer a valuation decline. When MSC uses public company valuations to value private companies, it incorporates an additional risk premium to compensate for what is usually smaller company size and more limited access to capital markets. Therefore, interest rate increases that cause public technology stocks to decline will also hurt private company valuations. Finally, approach #3 incorporates interest changes into private company valuations, but with a significant lag. This approach uses exit multiples to estimate values for private companies yet to exit. As interest rates rise, these exit multiples should decline like those of public stocks. When MSC creates lists of precedent private transactions, it generally looks back five years. In the event we see a trend of declining multiples, we will estimate a more conservative multiple for the private company yet to exit, resulting in a lower valuation.

What are the key takeaways for a Founder?

Timing of recessions should matter less to the seasoned entrepreneur than diligently planning, funding, and building a sustainable business.

Technology stocks likely foresaw one or two quarters of real GDP decline, and they reacted to meaningful increases in interest rates.

Although the US economy may see a second consecutive quarter of negative real Gross Domestic Product (GDP), it is unlikely to experience a “recession” now because the National Bureau of Economic Research (NBER) is unlikely to qualify 1H22 as a period of “significant decline in economic activity.”[8]

Stocks of technology companies with no current earnings are exceptionally sensitive to interest rate movements, and they should decline when interest rates rise.

About Marion Street Capital

Marion Street Capital (MSC) is a business growth consulting firm helping innovative growth companies solve their most pressing challenges.

We collaborate with ambitious leaders to provide time-saving partnership, unparalleled support, and world-class expertise designed to ensure lasting business success — at scale. We work with clients to achieve growth of 10x or more by delivering world-class services in five key areas: FinOps, DataOps, RevOps, HROps, and SpecialOps.

MSC’s resources include relationships with institutional investors (family office, private equity firms, venture capital firms, hedge funds, and mutual funds), relationships with local and international banks, “expert networks,” relationships with top academic institutions, outsourced software development teams, graphic design services,

and industry information providers. This robust suite of services enabled MSC to help clients across 16 different industries during the last two years

Footnotes

[1] 10-Year Treasury Constant Maturity Minus 3-Month Treasury Constant Maturity (T10Y3M) | FRED | St. Louis Fed (stlouisfed.org)

[2] Financial Times Alphaville

[3] Business Cycle Dating Procedure: Frequently Asked Questions | NBER

[4] Recession | U.S. Bureau of Economic Analysis (BEA)

[5] Business Cycle Dating Procedure: Frequently Asked Questions | NBER

[7] MSC estimates

[8] Business Cycle Dating Procedure: Frequently Asked Questions | NBER

![Figure 1. St. Louis Federal Reserve Bank History of Recessions preceded by Treasury curve inversions[1]](https://images.squarespace-cdn.com/content/v1/5e602cc2ecae0b6abfd08490/e6779ce1-9166-4be8-9146-090b7bae876b/R+Word+1.PNG)

![Figure 2. Goldman Sachs Non-Profitable Tech Basket Index[2]](https://images.squarespace-cdn.com/content/v1/5e602cc2ecae0b6abfd08490/ca85c825-b951-463a-9eab-c6ee204703b9/R+Word+2.PNG)

![Figure 4. US Treasury curves during the past year[6]](https://images.squarespace-cdn.com/content/v1/5e602cc2ecae0b6abfd08490/52c70088-8969-475b-82b6-74612db8a172/R+Word+4.PNG)