Filter By Category

A Guide to Business Growth Consultants & Development Consulting

Regardless of your industry, adaptability is the keystone of success in modern business. With technological advancements reshaping industries and global events disrupting markets, organizations face unprecedented challenges that make it difficult to identify advantageous investment opportunities.

Valuation Advisory Services that Optimize Transaction Outcomes

Traditional business valuation reports often contain several weaknesses that can jeopardize business transactions, whether you’re looking to scale or sell. After evaluating many inferior third-party valuations that caused their associated transactions to fail, we’ve identified some of the most common errors that innovative growth companies should avoid during the valuation process and when working closely with valuation advisors.

FinOps Venture Capital Strategies & Private Equity Consulting to Raise Capital

Accessing capital efficiently and effectively is paramount for startups and companies seeking growth and expansion opportunities. Marion Street Capital (MSC) specializes in providing unparalleled private equity and venture capital consulting through our FinOps services to companies at every stage of their fundraising journey, offering a range of tools designed to streamline the capital-raising process and maximize success.

Coping with Executive-Level Mental Health Challenges: Solutions for Company Leaders

In the fast-paced lifestyle of company leaders, founders, and C-suite executives, high-stakes decisions and relentless demands are the norm. Unfortunately, mental health, therefore, often takes a back seat. The challenges these leaders face can be overwhelming, impacting their personal well-being and the overall health of the organizations they lead. Marion Street Capital was granted an exclusive and insightful interview with Johnny Crowder, CEO of Cope Notes, who sheds light on the mental health struggles of company executives and explores innovative solutions that provide comprehensive support and enhance mental well-being for startup founders to long-term CEOs—and how you can do the same.

SVB & Signature Bank Fail: Three Strategies to Maximize Liquidity

Marion Street Capital recommends that innovative growth companies immediately take three steps to mitigate liquidity risk. The failure of Silicon Valley Bank (“SVB”) and Signature Bank caused widespread uncertainty regarding the stability of regional banks, and it nearly caused dozens of innovative growth companies to fail as their abilities to process payroll were briefly threatened. This led to record inflows of $15B in customer deposits to bulge bracket banks like J.P. Morgan Chase and Bank of America.

MSC Huddle: Seed Investing Outside of VC Hubs

Marion Street Capital hosted its first Huddle of 2023 to speak with expert VC and angel investors about the challenges that companies located outside of the major venture capital hubs face when raising seed capital.

The Metrics Investors Want: Quantitative Forecasting for Seed Series A Startups

Originally published on Toptal, the industry leader for the top 3% of outsourced talent: It’s a catch-22 for young startups: How do you attract investors with compelling financial projections if you don’t have historical data? Here’s a three-part strategy for making the most of what you’ve got to seal the deal.

Investing in the Future of Self-Driving Cars

Ivee, a SaaS mobility company improving the passenger experience, in partnership with Marion Street Capital hosted a roundtable in which experts from Blacklane and Toyota Boshoku shared their insights around expected trends in the transportation industry and the increased importance of the passenger experience in this industry.

MSC Huddle: Demystifying Family Offices for Growth Companies

Marion Street Capital hosted its third huddle focusing on Demystifying Family Offices for Growth Companies where experts discuss recent investing trends and common mistakes by entrepreneurs when approaching family offices.

How do Technology Incentives Prevent Climate Change?

On November 15th, 2022, Sean Heberling, CFA spoke at the 40th AMT Conference hosted by the Global Interdependence Center, discussing the role tech and incentives have in combatting climate change.

The KPI Cure: How Healthcare Data Analytics Can Improve Medical Center Finances

Originally published on Toptal, the industry leader for the top 3% of outsourced talent: Runaway costs have plagued the US healthcare system for decades, and providers are always looking for ways to increase efficiency without jeopardizing care. Developing smarter key performance indicators can help.

MSC Huddle: Workforce Management in an Economic Downturn

Marion Street Capital hosted a HR Huddle where executives and HR professionals discussed how to motivate employees and address complex HR situations in the current economic climate. Additionally, the panel discussed trends in HCM and technology, and where the industry is headed as more firms look to undergo digital transformation.

MSC Huddle: Raising Capital for your Early-Stage Company in the Current Economic Environment

Hear how venture capitalists and founders shared how they would navigate raising capital for early-stage companies in the current economic environment.

How much should a recession matter to an early-stage company?

The three MSC playbooks for early-stage companies do not change during recessions, though we may selectively favor either offensive or defensive strategies for some companies and industries. We built these three playbooks by helping client companies get financing and solve real challenges to grow from $0 to $1MM, from $1MM to $10MM, and from $10MM to $100MM in annual revenue during an economic expansion, contraction, and subsequent expansion. Interested in learning more about how your company can thrive during a recession?

Bitcoin: A Look Back, and a Look Ahead

Why Marion Street Capital projects Bitcoin may reach $61,618 by December 31, 2022, and a dive into other quantitative methods to price Bitcoin, including ARK Investments’ recent whitepaper.

Unlocking the Potential of the Plant - Overcoming Limitations in Cannabis

Although the cannabis industry is growing rapidly and may reach $43B in revenue by 2025, firms are asking questions on how they get there. With less access to institutional funding, limited business intelligence, and lack of key business benefits such as banking, the number of levers to pull as firms try to scale are limited when compared to other industries. How should firms address these key issues?

Electric Everywhere: Where EV’s are Headed Next

In 2020, global electric car sales managed to reach 4.6% of total car sales, a 70% increase from 2019. As electric cars continue to cannibalize sales of existing gas-powered cars, it is time to shift focus on how the story will be written for other automotive and transportation industries. How will electric technology create opportunities for emerging firms in the recreational vehicle industry, including ATVs/UTVs, snowmobiles, boats, and bikes?

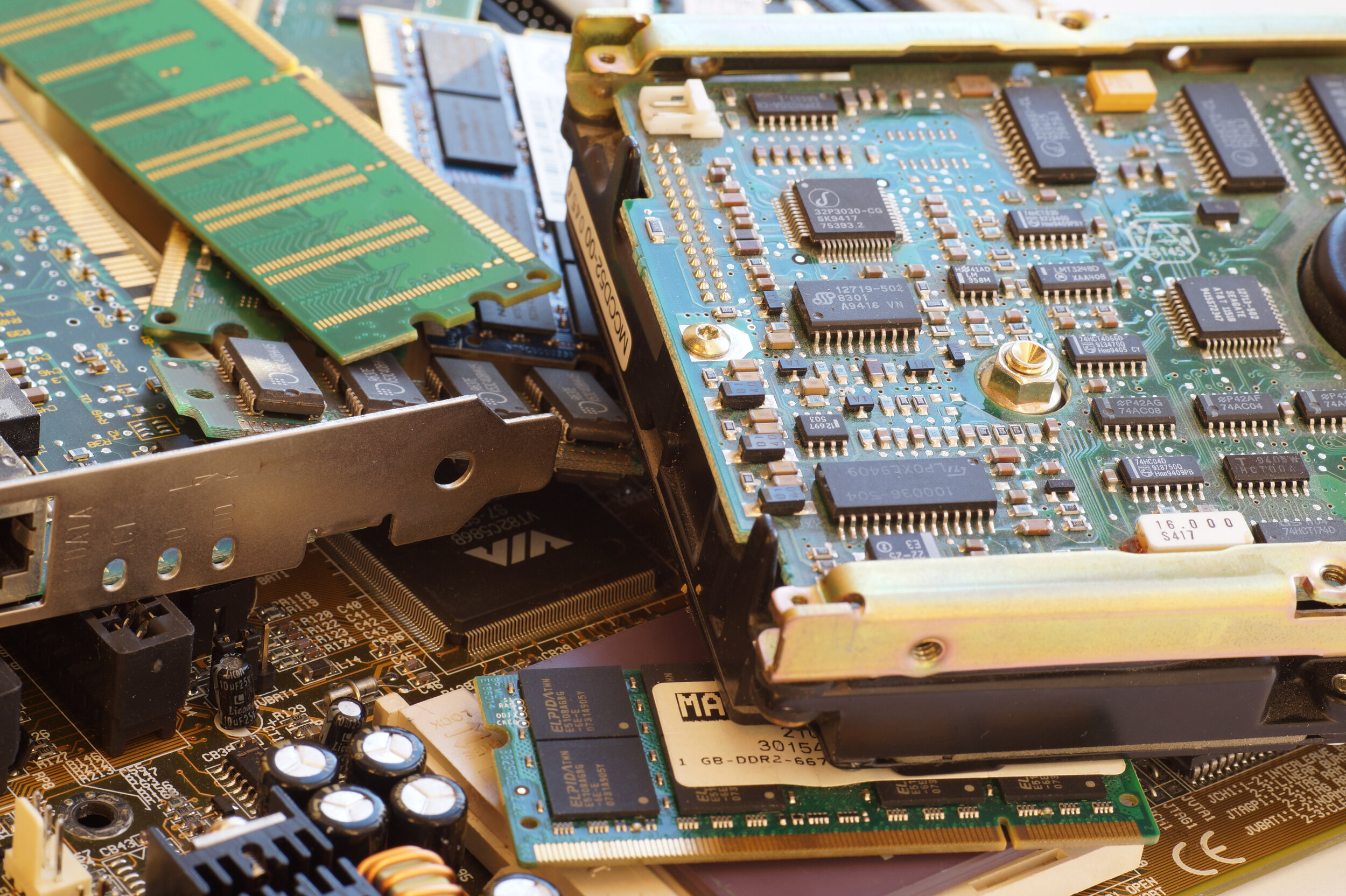

The Growing Market for CCUS and E-Waste

The carbon capture, utilization, and storage (CCUS) and electronic waste (e-waste) industries are likely to benefit under the climate friendly policies of the Biden/Harris administration. Only 20% of e-waste, the world’s fastest growing and most toxic waste stream, is currently recycled. How are governments around the world addressing these pressing issues at a critical time for the environment, and how should industry players respond?

The Current State of U.S.-China Relations

Political and economic relations between the U.S. and China have been a key issue over the past three to four years. The Global Interdependence Center’s recent webcast provides key insights on how China’s economy has fared through the COVID-19 pandemic, and how the 2020 U.S. Presidential election could impact relations in the next few years.

Quantifying the Boom in Gaming and Esports

Over the past few years, gaming and live streaming have experienced significant growth, supplemented by an increase in the number of organizations and legitimacy of esports leagues. What changes in the gaming and esports models have prompted this growth, and how should startups or new teams navigate the boom in public and private investment in this space?